Open banking allows non-banking organisations to offer financial services to customers via application programming interfaces (APIs). And since its inception in 2018, it’s been changing the way people manage their money. From personal money management apps and price comparison services to accounting apps for businesses, today more than six million UK companies and consumers use open banking to stay on top of their everyday finances.

For providers of open banking apps and services, it’s a hotly contested and often unforgiving operating landscape. In fact, half (50 per cent) of financial services customers say they would walk away from a company after a single bad experience. As a result, customer experience (CX) has long been the financial services industry’s top priority.

But how can financial services providers ensure they deliver an experience that meets people’s high (and evolving) expectations? The key is having a customer-first philosophy in which the needs of users are at the heart of any products and services they develop.

Data privacy and transparency are key

For many years, information about financial transactions was held by banks and building societies. Yet the arrival of open banking forced them to share that data with non-banks (with the consent of customers), sparking a new wave of innovation. This, in turn, means businesses and individuals can now leverage their own banking data to access tools designed to help them get the most out of their money.

Yet, of course, the ability to share financial data also brings some uncertainty. People are wary about giving third-party financial services providers (TPPs) access to their information and many may not know, for example, that open banking is closely regulated by national authorities, such as the Financial Conduct Authority (FCA) in the UK and its European equivalents.

Understanding that TPPs must follow these strict data security rules could help address hesitant customers’ concerns and give them the confidence they need to get started with open banking. It’s therefore vital that companies are clear with customers about how their financial information will be used, stored, and secured.

Investing in Artificial Intelligence (AI) is investing in your customers

AI can also be a powerful tool in delivering the seamless experience customers demand. By helping businesses automate simple tasks while learning about customers and their behaviours, AI can help financial services companies deliver a more personalised and effective CX.

Personal banking app Cleo is a great example. Designed to help Gen Z customers manage their money, the app uses an AI chatbot to connect with people in an engaging and entertaining way. Information is delivered in a conversational, friendly tone, often with accompanying memes. The app has some fun features too, including a ‘roast’ option, which provides witty observations about the user’s spending habits. These roasts are highly shareable and have gone viral on social media, helping Cleo attract more customers.

What’s more, as AI technologies evolve, people and businesses are becoming more aware of its benefits. Zendesk’s chatbot and AI research reveals that 39 per cent of UK consumers expect AI to improve the customer experience they receive from companies. Meanwhile, a third (32 per cent) of businesses are allocating 10 to 24 per cent of their customer service technology budget to investing in AI. Both these factors will help accelerate progress.

Open banking in action

So, what does data-secure, AI-driven CX in open banking look like in practice? Here are two examples of financial service providers that are delivering impressive customer satisfaction results (CSAT) through a variety of AI tools.

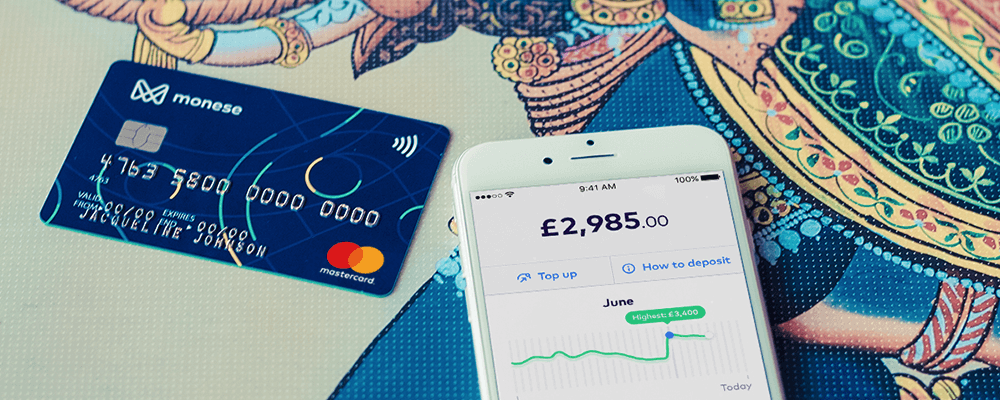

Monese

Monese provides a banking app with an account and debit card that makes it easier for people to get set up in a new country, making it especially popular with immigrants and returning expats who need borderless access to their money. Crucially, it uses Zendesk’s omnichannel solution to support its broad customer base. This is another key element in delivering an efficient and scalable open banking service as it allows customers to enjoy a seamless and efficient experience no matter how or where they are interacting with their financial services provider.

Since implementing Zendesk, Monese has increased customer satisfaction by 10 per cent while reducing its overall first response time (FRT) by 59 per cent. The company has also leveraged Zendesk Guide to better manage tickets, providing help centre articles in eight languages. This means that when customers request support from the app, they are served exactly the right help centre article before the support phone number is shown.

TrueLayer

TrueLayer’s open banking platform enables engineers and businesses to build better financial experiences for their customers. Using its open APIs, businesses can securely access financial data from their customers’ bank accounts to facilitate transactions and validate customer identity.

As part of its customer service strategy during the pandemic, TrueLayer invested in Zendesk Sunshine. Using this customer relationship management (CRM) platform, the company was able to connect all of its customer data in a single customer view, which improved response rates at a time when the tech industry was under significant pressure. The company also uses Zendesk Guide to store and serve FAQ articles for users. Impressively, TrueLayer’s CSAT is now more than 95 per cent.

Standing out from the competition

The current economic situation is leading many individuals and businesses to re-examine their financial priorities. More than ever before, people want greater control over their money without having to compromise on the security of their data and without having to spend huge amounts of their precious time managing their finances day-to-day.

This represents a real and exciting opportunity for any financial services company able to offer open banking solutions that meet this need. In a crowded and competitive market, delivering a truly effective and differentiated experience can be tough. But invest in getting their CX right now, and they may well find themselves leapfrogging their competition into the future.