Article • 7 min read

5 ways financial services are banking on conversational customer support

Is it really true that financial service companies lag behind in adopting new software and technology?

By Hannah Wren, Staff Writer

Last updated December 5, 2022

Why is it that financial services have a reputation for being slow to adopt new technologies? Well, according to Forbes, factors like high regulation as well as difficulty in building and deploying new tech make it difficult.

Despite this reputation, financial service institutions like banks and lenders are actually adopting new technologies. Our data shows that upwards of 70% of customers expect brands to have conversational experiences when interacting with brands, and their expectations are no different when it comes to financial institutions.

Consider the use of messaging channels to stay in touch with customers, AI-powered bots to triage inquiries and back-end user interfaces that make it easy for financial institutions to stay on top of customer data securely.

Below, we’ve outlined five ways conversational experiences like messaging, bots and AI are being used in the financial industry to create better customer experiences that pay off in the long run.

1. Modernising the contact centre

Think of the hallmarks of a bad customer experience: Long wait times, repeating oneself constantly and arriving at a solution with as much friction as possible – if at all. Legacy contact centre software can compound all of these problems, and banks are no strangers to legacy software solutions.

Cleaning up the agent interface is a great place to start. The legacy contact centre software that financial institutions typically rely on is often a mishmash of on-premise software, third party integrations and outmoded channels built up over years. Calls, emails, and maybe even live chats are handled in their own silos, creating inefficiencies that end up costing these institutions more than they need to be spending.

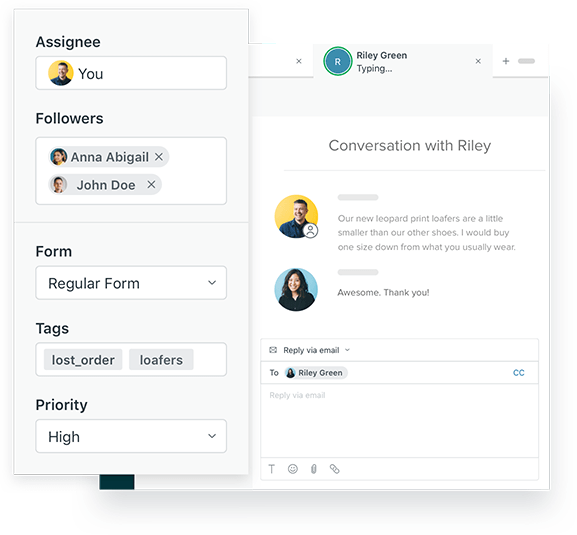

A modern, conversational interface where agents can keep track of all of their tickets from any channel – be it via messaging, the phone, or email – helps your teams in the long run. In order to maintain a seamless experience, Zendesk’s Agent Workspace surfaces relevant customer data that saves time for agents.

Agents have visibility into previous interactions and customer details, as well as access to time-saving automated workflows, macros and triggers that boost agent efficiency. Perhaps most importantly, Zendesk can be integrated securely with other systems used in the organisation.

2. A more personal customer experience

Why do customers desire a more personalised experience? Often it’s because interactions with brands can feel deeply impersonal. When people are treated like a number or a ticket rather than what they are – people – they will be more incentivised to look elsewhere for service.

Consider the many ways people interact with financial service brands day-to-day. They’re sending money in third-party apps, checking their online banking, applying for loans and credit cards, and scheduling appointments with lenders and advisors. Each of these brands and institutions will have a large digital footprint that their customers will be familiar with. When it comes time for these customers to seek support, they want to be recognised for who they are and the amount of time they spend with these brands.

One way of ensuring personalisation in the customer experience is by offering support via messaging channels, like WhatsApp or iMessage, and across your web and mobile presence. Embedding support across multiple channels creates a consistent experience, and the right tools on the backend make it feel seamless for the customer.

Some messaging channels can be used to send notifications to customers – like if a loan or wire transfer is approved. If customers hop into the conversation or respond to the notification, the agents have the full context to understand the nature of the query without obligating the customer to repeat themselves.

3. Actionable, proactive support

With proactive messaging support, companies can anticipate customer needs before they arise. For example, enabling messaging on a website to help with lead generation while applying for a loan, which often requires a long, multi-step web form. Embedding messaging allows prospects to ask questions before they get stuck, lowering the chances they’ll give up and abandon the form.

Banks can use messaging to proactively notify customers of suspicious charges, when it’s almost time to pay a bill, or if an account balance is running low. What makes these notifications actionable is that customers can act on them within the thread, for instance, by confirming that they made a flagged charge or asking to pause their card if they didn’t. If the message is coming from a verified business profile rather than a mysterious text message, the customer will feel more secure during the transaction. Features such as WhatsApp’s Verified Business Profiles add credibility on third-party messaging channels because customers know who the notification is coming from.

Outbound messages are proactive, but most of the time they aren’t conversational. A truly conversational experience requires a connective layer of tissue that unifies messages from every channel into a single conversation, giving agents the context that allows them to know which outbound message the customer is responding to. They also gain access to relevant background information on that customer, like their name, email and account type. Without access to that crucial context, agents are completely in the dark, and fast, personal responses are next to impossible.

4. Automation for more efficient workflows

Despite the reputation that banks are reluctant to adopt new tools, there are a few well known instances of financial service brands banking on bots. Bank of America’s chatbot Erica, for example, deflects up to 98% of customers’ requests from being escalated to an agent, while surfacing account usage insights and upselling services.

Automation can save financial institutions a lot of time by deflecting common queries and ensuring conversations are routed to the right department or agent with the right expertise. Bots can be configured to reply to FAQs, surface knowledge base material and guide the conversation to a resolution before a real person needs to get involved.

If live support is necessary – and it often is – bots can collect qualifying information to route the conversation to the right place, supplying the agent with context.

When fintech innovator Mode needed to overhaul their customer experience, they rolled out messaging and automation to tackle high ticket volume and better manage customer relationships. Built-in automation means Mode can answer queries 24/7 while decreasing ticket volume, so agents have time to focus on higher-touch queries.

“Zendesk includes part of the bot conversation in the ticket so we have full context and can continue the interaction in a seamless way” says Phil Andrews, a senior customer operations executive. “From a CX perspective, it’s useful to see which options customers have already clicked. On the agent side, it’s helpful to have a record of the conversation, so we can prevent information loss and save time by not repeating answers.”

5. An integrated, holistic experience

Conversational experiences create better customer experiences, but support is only one aspect of the customer relationship. To provide world-class customer service, financial institutions need a support solution that works in tandem with their other systems.

When LendingClub integrated their Cisco phone system in Zendesk, they freed up time for dedicated agents to focus on other channels, streamlining workflows with automation and deflecting FAQs with Answer Bot.

Free ebook – How financial service companies use Zendesk to transform the customer experience

“Answer Bot has been helpful in addressing some quick questions for our customers. We’re happy to see customers find the answers they need when they need them. Answer Bot points them in the right direction to find solutions independently” says Alina Doyle, a LendingClub specialist.

Creating and managing a knowledge base can decrease the number of tickets your agents need to deal by giving customers a chance at self-service, while automation can surface knowledge base articles in conversations to guide the customer to a solution before escalating to an agent.